Andelene i FaZe Clan synker til rekordlave siden sammenslåingen

Shares of North American esports organization FaZe Clan on the NASDAQ exchange fell to a record low since the merger. Probably the reason for the fall in quotes was the company's recent filing with the SEC, as well as general market turmoil.

Recall that in July, the FaZe Clan organization was officially listed on the NASDAQ under the ticker "FAZE". Interestingly, immediately after entering the NASDAQ exchange, the club's quotes fell by almost 30%.

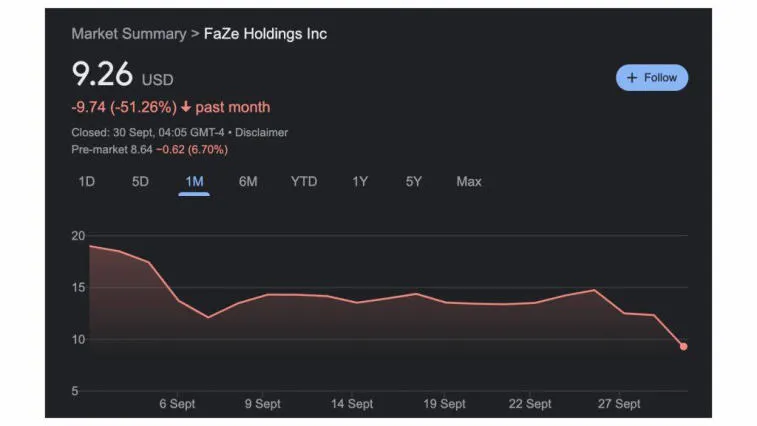

First, the organization's share price fell from $13.02 to $9.58 in a matter of days. However, the stock rose after that, peaking at just over $20 in early August. However, two months have passed since that peak, and after the company filed an S1 application, the share price fell to $9.12, the lowest value since the merger with B. Riley Principal 150 Merger Corp.

On September 26, FaZe Clan filed an S1 form with the SEC, outlining its intention to issue new shares as well as an insider selling period. In total, the club plans to issue 5.9 million new shares, as well as up to $64 million in insider sales. Simply put, all of these new shares on the market are likely to drive down the value of each share as supply outweighs demand.

Note that in August, the FaZe Clan organization submitted its financial results for the second quarter ended June 30, 2022 to the SEC. Listed on the Nasdaq ticker "FAZE", the merger generated $57.8 million in net revenue for the club, according to the report.

Kommentarer