Den virkelige årsaken til kryptomarkedskrakket: Analyse bak kulissene

On the night of January 31, 2026, the crypto market experienced one of its most dramatic crashes in history. In just a few hours, positions worth over $2.5 billion were liquidated, and the total market capitalization shrank by $230 billion. This event became the 10th largest liquidation in crypto history, all amid a complete absence of fresh news. Experts from Telegram channels and X rushed to explain the crash with various reasons, from geopolitics to corporate reports. But let's figure out what's true and what's just noise. We rely on the provided data and fresh research from open sources, including market analysis from CoinDesk, Forbes, and others.

Record Losses Over the Weekend

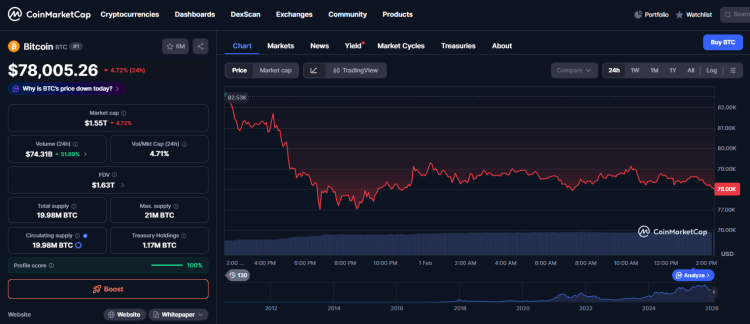

The crash began on Saturday evening when traditional markets were closed, and liquidity on crypto exchanges was minimal. Bitcoin fell below $78,000, losing up to 8% in a day.

Ethereum, below $2,400, and altcoins like Solana and Dogecoin plummeted by 10-20%. The total liquidation volume exceeded $2.5 billion, with 93% being long positions.

This isn't the first such incident: for comparison, during the FTX collapse in 2022, $1.6 billion was liquidated, and during COVID-2020, $1.2 billion. But this crash stands out because it coincided with a drop in "safe" assets: gold fell by 11% (worst day since 1980), silver, by 31% (a record). When risky and protective assets fall together, it's a sign of forced sales due to margin calls, not fundamental issues.

Breakdown of Popular "Reasons"

Many analysts hastily linked the crash to external events. Here are the key theories and why they don't hold up:

American Bank Bankruptcy

Some X posts tied it to the insolvency of a Chicago bank with assets of just $500 million.

They compared it to the Silicon Valley Bank collapse in 2023, where assets reached $209 billion, and uninsured deposits were 86%. But the news about the Chicago bank came out on Friday, January 30, and its size is too small to cause a global shock. This isn't SVB 2.0, just a local incident already priced in by the market.

US Government Shutdown

As of January 31, the US government technically halted operations due to Congress not passing a budget. The previous shutdown in October 2025 lasted 43 days and hit markets. However, this time the Senate has already approved funding for most agencies, and the House of Representatives will return to work on Monday, February 2. This is a short-term "technical" shutdown, not a crisis. Historically, such events cause volatility but are quickly forgotten, the market has already factored this in.

Geopolitics: Iran, Tariffs, and Microsoft Report

This week, tensions between the US and Iran escalated, an explosion in Bandar Abbas port, Trump's threats to strike Iran if talks fail. Add to that Microsoft's poor quarterly results (shares fell 10%), and new US tariffs on oil suppliers to Cuba. All this hit tech stocks and oil, but the events happened mid-week, not on Saturday evening. The negativity was priced in by Friday: S&P 500 and Nasdaq closed in the red, but without panic. Why did crypto crash specifically over the weekend? Because low liquidity amplified the effect.

Additional factor from research: Nomination of Kevin Warsh as Fed Chair. Trump picked a "hawk" signaling a delay in rate cuts until June or later. This increased pressure on risky assets, including crypto. Plus outflows from Bitcoin ETFs: $1.61 billion in January, peaking at $818 million on January 29. But even this doesn't explain the suddenness of the Saturday crash.

Manipulation or Insider Trading?

Based on our data, including analysis from Glassnode and CryptoQuant, the cause of the crash remains unknown. This isn't a macro shock like a recession (S&P 500 premarket showed no panic) or a mass exit by long-term holders. Rather, it looks like market manipulation or insider trading. Why?

- Traditional markets are closed, volumes on crypto drop, ideal conditions for a "shakeout" (stopping out leveraged positions). Longs were overheated: open interest exceeded $53 billion, and funding rates signaled speculative excess.

- As Stanley Druckenmiller noted, the crash is a "mini black swan" from over-leveraging, not fundamentals. Data shows the structure broke first (long-term holder sales at $84,600), then liquidations accelerated the fall.

- If something "scary" happened (war, regulations), it would show in stock futures. But the charts are calm.

In X posts, analysts note:

"When forced selling ends, snapback could be violent", expect a sharp rebound once pressure eases.

The Fear & Greed Index (FGI) is at "Extreme Fear" (14), a classic signal for contrarians.

What's Next?

The market awaits Monday: US opening, shutdown resolution, and possible Fed comments. If liquidity returns and insiders reveal their hand, we'll see a rebound. Otherwise, a test of $75,000 for BTC. But history shows such crashes often mark local bottoms. Long-term: macro drivers (money printing, tokenization) remain strong.

This isn't the end of the bull market, just a shakeout. Stay vigilant and don't believe every "expert" on social media.

3 gratiskasser og en bonus på 5 % på alle kontantinnskudd.

5 gratis saker, daglig gratis og bonus

0 % gebyrer på innskudd og uttak.

11 % innskuddsbonus + FreeSpin

10 % EKSTRA INNSKUDDSBONUS + 2 GRATISSPINN PÅ HJUL

Gratis case og 100 % velkomstbonus

Kommentarer