Institusjonelle investorer anser Bitcoin som undervurdert til tross for prisfall

According to a recent survey from Coinbase, conducted in collaboration with Glassnode, about 71% of institutional investors believe that Bitcoin is undervalued at current prices in the range of $85,000 to $95,000. This is despite the cryptocurrency falling by over 30% from its all-time high of $126,080, achieved in October 2025. The survey, which ran from December 10, 2025, to January 12, 2026, covered 148 respondents, of which 75 were institutional investors and 73 were independent.

According to the Coinbase report"Charting Crypto Q1 2026", 25% of institutional respondents consider Bitcoin's price fair, while only 4% see it as overvalued. Among independent investors, the opinion is somewhat softer: 60% consider BTC undervalued. These data highlight the resilient optimism among professional market players, despite macroeconomic pressures and Bitcoin lagging behind traditional assets.

Comparison with Traditional Assets

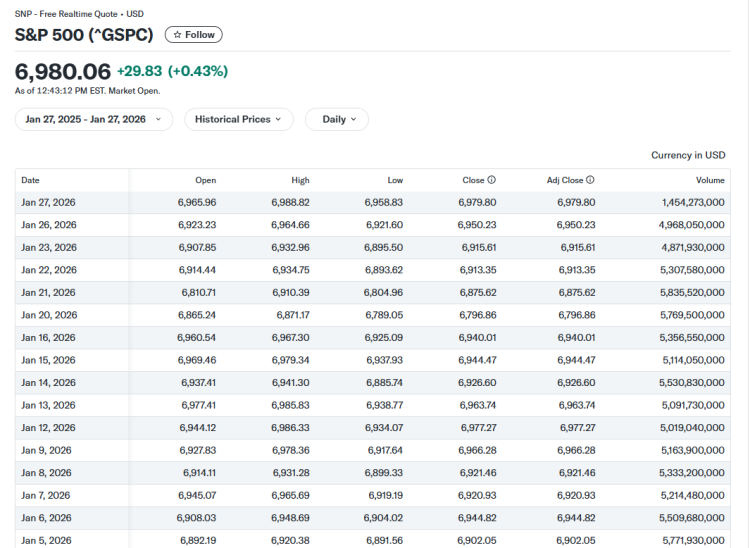

The survey emphasizes that Bitcoin is lagging behind precious metals and the stock market. Gold, for example, has reached a mark above $5,000 per ounce, which is a new all-time high, while silver has doubled its market value since October 2025. The S&P 500 index has risen by 3% over the same period, while BTC has lost a significant share. As of January 27, 2026, the price of gold is hovering around $5,076 per ounce, and the S&P 500 closed at 6,950 points, which is 16% higher than a year ago.

The current Bitcoin price is around $87,600, which corresponds to the range indicated in the survey. Experts from Coinbase note that such an assessment reflects confidence in the long-term potential of the cryptocurrency as a strategic asset, especially amid regulatory changes and growing institutional interest.

Community Reaction

On the social network X, the news quickly gained momentum. User @OltaFinance emphasized:

"New survey from @coinbase shows that about 70% of institutional investors consider Bitcoin undervalued even after recent volatility. This indicates strong confidence from professionals in digital assets."

Similarly, @bitinning noted:

"70%+ institutional investors and 60% independent consider Bitcoin undervalued at prices $85K-$95K."

An earlier Coinbase survey from 2025 showed that over 75% of institutions plan to increase allocations to digital assets in 2025-2026, with 59% of them planning to allocate over 5% of their portfolio. Analysts predict that 2026 could be a transformative year for the crypto market thanks to clearer regulations and integration with traditional finance.

3 gratiskasser og en bonus på 5 % på alle kontantinnskudd.

5 gratis saker, daglig gratis og bonus

0 % gebyrer på innskudd og uttak.

11 % innskuddsbonus + FreeSpin

10 % EKSTRA INNSKUDDSBONUS + 2 GRATISSPINN PÅ HJUL

Gratis case og 100 % velkomstbonus

Kommentarer