Solana Memecoin-handel når rekordlave nivåer: Endring signaliserer et modent marked eller slutten på hypen?

In a surprising turn for the Solana ecosystem, memecoin trading volume has plummeted to under 5% of the daily decentralized exchange (DEX) activity on the network - the lowest level since the memecoin frenzy kicked off two years ago.This revelation came from Solana co-founder Anatoly Yakovenko, who retweeted a post highlighting the data, noting that despite the decline, Solana's overall DEX volume continues to outpace all other Layer 1 (L1) and Layer 2 (L2) blockchains combined.As of late November 2025, Solana's DEXes are processing billions in weekly trades, but the once-dominant memecoin sector appears to be fading into the background.

A Sharp Decline in Memecoin Dominance

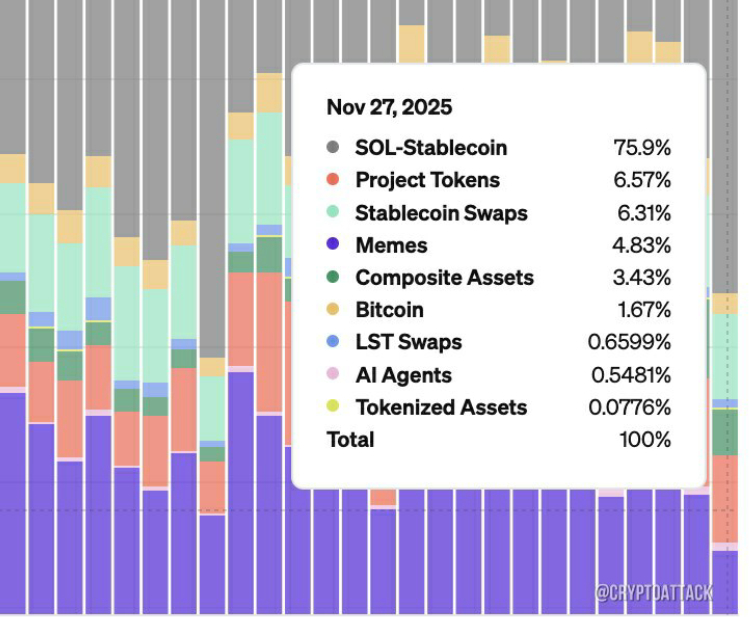

According to recent analytics, memecoin activity on Solana has seen a dramatic cooldown. Weekly DEX volumes remain robust at over $18.6 billion, but new memecoin launches have halved from peaks of over 220,000 per week in early 2025 to around 110,000 now.This has led to a ripple effect: trading bot revenues have tanked, and launchpad platforms like Pump.fun are experiencing reduced hype.Earlier in the year, memecoins accounted for over 60% of Solana's DEX volume, but that share has now dipped below 30% in some periods, with stablecoin pairs surging to fill the void.

The broader memecoin market has also suffered, with the sector's total market cap sinking to 2025 lows after a $5 billion wipeout in a single day last week.Mindshare for memecoins - measured by social mentions and investor interest,has collapsed nearly 90% since 2024 peaks, as capital rotates toward more "serious" sectors like AI and DeFi.

Unpacking the Reasons of Drop

Several factors have contributed to this downturn, based on market analysis and community discussions:

- A wave of high-profile rug pulls and scams has battered user confidence. Solana's user activity dropped nearly 40% earlier in 2025 due to these incidents, driving capital outflows to safer chains like Ethereum and Arbitrum. Controversies around launches like $LIBRA in February acted as a "final nail in the coffin," deterring new traders and leading to a 7 million drop in unique traders over 10 months. As one analyst noted, "Newbie traders have to fight against multi-wallets, bundlers, and KOL farms," making it increasingly difficult for retail investors to profit.

- While overall DEX volume holds steady, funds are concentrating in fewer, more verified projects rather than scattering across thousands of speculative memecoins.Stablecoin trading has surged to its highest since late 2023, indicating a shift toward utility over hype. Investors are moving to AI-driven tokens and DeFi protocols, with memecoins seen as "extreme fear territory" amid low liquidity.This "November purge" wiped out small-time degens, leaving survivors with exchange listings (e.g., on Coinbase) to absorb the remaining capital.

- Solana itself has underperformed, down 22% in a recent dip as memecoin fading exposed its reliance on the sector.Events like the Upbit hack had minimal impact on resilient memecoins like $BONK or $MOODENG, but overall fatigue from a 99% rug rate has pushed traders toward perps or equities on blockchain.Community sentiment echoes this: "The ease of entry for any brokie to be a dev and rug other retail investors" has rinsed retail, with no resurgence expected in the next cycle.

- Platforms like Pump.fun, which dominated Solana's memecoin launches and generated hundreds of millions in fees, have seen reduced activity post their $PUMP token drop and buybacks.Meanwhile, other chains like Base and BSC are capturing minor surges, but Solana still leads in speed and low fees - keeping core volume intact.

What’s Next for Solana and Memecoins?

This decline could signal a maturing Solana ecosystem, pivoting from volatile memecoins to stable, high-utility trading. However, some see green shoots: Recent activity on Pump.fun hints at potential rallies, and resilient tokens continue to trade.If trust rebuilds through better verification and regulations, memecoins might rebound,but for now, the era of easy 100x gains seems over. Solana's dominance in DEX volume proves its resilience, but the memecoin "trenches" may need reinvention to attract fresh capital.

As always in crypto, this is not financial advice - DYOR and trade responsibly.

3 gratiskasser og en bonus på 5 % på alle kontantinnskudd.

5 gratis saker, daglig gratis og bonus

0 % gebyrer på innskudd og uttak.

11 % innskuddsbonus + FreeSpin

10 % EKSTRA INNSKUDDSBONUS + 2 GRATISSPINN PÅ HJUL

Gratis case og 100 % velkomstbonus

Kommentarer